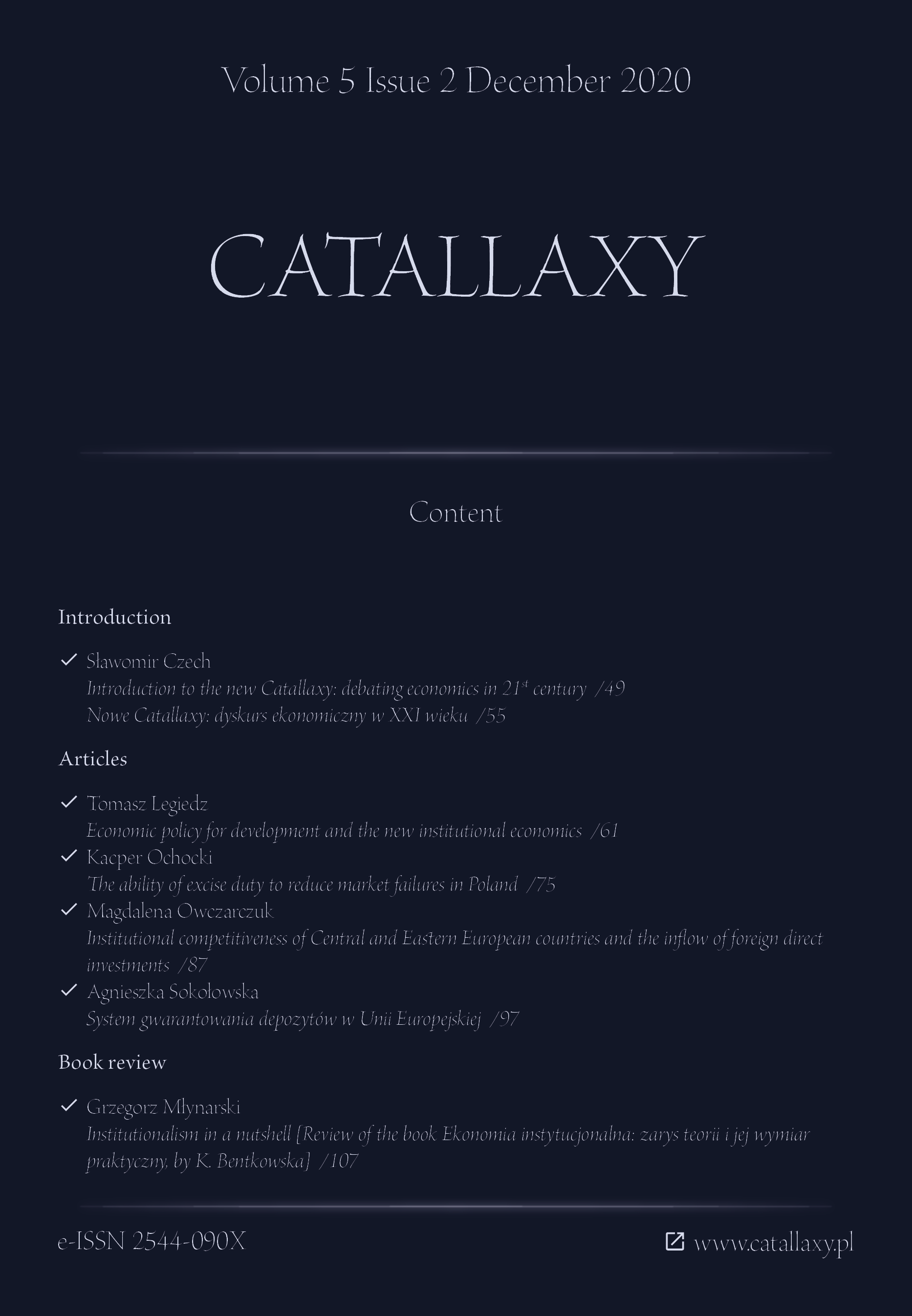

Institutional competitiveness of Central and Eastern European countries and the inflow of foreign direct investments

DOI:

https://doi.org/10.24136/cxy.2020.008Keywords:

FDI, competitiveness, institutions, GCI, institutional surrounding, CEE countriesAbstract

Motivation: Central and Eastern European countries (CEE) in spite of a long period of European Union membership and integration with the developed economies of Western Europe are still on the path of convergence, i.e. pursuing the highly developed countries in terms of, among others, GDP per capita. Assuming that the FDI inflow carries numerous benefits for the economic growth of the recipient country, those economies still compete against one another for foreign capital. One of the factors that attracts FDI is high quality of institutional surrounding.

Aim: assessment of institutional competitiveness of the selected CEE countries (Czech Republic, Estonia, Lithuania, Latvia, Poland, Slovakia, Slovenia, Hungary) as well as verification of the relationship between institutional competitiveness and the FDI inflow to the analyzed economies.

Materials and methods: The article reviews positions obtained by the selected CEE countries in the ranking of competitiveness published by Global Economic Forum (Global Competitiveness Report). The analysis and assessment of CEE countries competitiveness focused around the institutional quality assessment. Quantitatively, the connection was revealed between competitiveness ranking in the field of institutions and FDI inflow per capita and FDI as % of GDP to the economies under consideration.

Results: the analysis of the global competitiveness index (GCI) allows to notice that among the CEE countries, Estonia is characterized with the highest institutional competitiveness. The detailed analysis indicated that low social capital quality decreases institutional competitiveness in case of all analyzed economies. The conducted quantitative analysis of the potential link between the GCI?Pillar 1. Institutions index and the inflow of foreign direct investments to CEE countries indicates the positive correlation of those variables. Higher index values (institution quality assessment) corresponds to the higher FDI per capita level and FDI calculated as GDP percentage.

Downloads

References

Acemoglu, D., & Robinson, J.A. (2012). Why nations fail: the origins of power, prosperity and poverty. New York: Crown Publishers.

Angeles, L. (2011). Institutions, property rights, and economic development in historical perspective. Kyklos, 64(2). doi:10.1111/j.1467-6435.2011.00500.x.

Asiedu, E., & Lien, D. (2011). Democracy, foreign direct investment and natural resources. Journal of International Economics, 84(1). doi:10.1016/j.jinteco.2010.12.001.

Bailey, N. (2018). Exploring the relationship between institutional factors and FDI attractiveness: a meta analytic review. International Business Review, 27(1). doi:10.1016/j.ibusrev.2017.05.012.

Bochańczyk-Kupka, D. (2011). Systemic and institutional competitiveness of economic system. Journal of Economics & Management, 7(1).

Bossak, J.W. (2006). Systemy gospodarcze a globalna konkurencja. Warszawa: SGH.

Campbell, J.L., & Pedersen, O.K. (2007). Institutional Competitiveness in the global economy: Denmark, the United States, and the varieties of capitalism. Regulation & Governance, 1(3). doi:10.1111/j.1748-5991.2007.00012.x.

Choi, J.J., Lee, S.M., Shoham, A. (2016). The effects of institutional distance on FDI inflow: general environmental institutions (GEI) versus minority investor protection institutions (MIP). International Business Review, 25 (1). doi:10.1016/j.ibusrev.2014.11.010.

Contractor, F., Dangol, R., Nuruzzaman, N., & Raghunath, S. (2020). How do country regulations and business environment impact foreign direct investment (FDI) inflows. International Business Review, 29(2). doi:10.1016/j.ibusrev.2019.101640.

Czech, S. (2019). Od konfliktu do kooperacji: instytucjonalizacja konfliktu interesów zbiorowych w szwedzkim modelu gospodarczym. Warszawa: Scholar.

Dunning, J.H. (1973). The determinants of international production. Oxford Economic Papers, 25(3). doi:10.1093/oxfordjournals.oep.a041261.

Dunning, J.H. (2006). Towards a new paradigm of development: implications for the determinants of international business activity. Transnational Corporations, 15(1).

Gruszewska, E. (2020). Ekonomiczne aspekty praw własności: perspektywa instytucjonalna. In E. Gruszewska, & R. Przygodzka (Eds.), Instytucjonalne i strukturalne aspekty rozwoju rolnictwa i obszarów wiejskich: księga poświęcona pamięci dr. hab. Adama Sadowskiego, prof. UwB. Białystok: Uniwersytet w Białymstoku. doi:10.15290/isarrow.2020.01.

Hodgson, G.M. (2006). What are institutions. Journal of Economic Issues, 40(1). doi:10.1080/00213624.2006.11506879.

Huemer, S., Scheubel, B., & Walch, F. (2013). Measuring institutional competitiveness in Europe. CESifo Economic Studies, 59(3). doi:10.1093/cesifo/ift002.

Immergut, E.M. (1998). The theoretical core of the new institutionalism. Politics & Society, 26(1). doi:10.1177/0032329298026001002.

Jackson, G., & Deeg, R. (2008). Comparing capitalisms: understanding institutional diversity and its implications for international business. Journal of International Business Studies, 39. doi:10.1057/palgrave.jibs.8400375.

Kapas, J. (2020). Formal and informal institutions, and FDI flows: a review of the empirical literature and proposition for further research. Economic and Business Review, 22(1). doi:10.15458/ebr100.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: methodology and analytical issues. Hague Journal on the Rule Law, 3(2). doi:10.1017/S1876404511200046.

Morgan, G. (2007). National business systems research: progress and prospects. Scandinavian Journal of Management, 23(2). doi:10.1016/j.scaman.2007.02.008.

North, D.C. (1990). Institutions, institutional change and economic performance. Cambridge: Cambridge University Press. doi:10.1017/CBO9780511808678.

Owczarczuk, M. (2014). Atrakcyjność inwestycyjna Polski z perspektywy instytucjonalnej. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach. Studia Ekonomiczne, 184.

Owczarczuk, M. (2020). Instytucje a napływ bezpośrednich inwestycji zagranicznych do Polski. Białystok: Uniwersytet w Białymstoku.

Powell, W.W., & di Maggio, P.J. (Eds.). (1991). The new institutionalism in organizational analysis. Chicago: University of Chicago Press.

Rugman, M. (1980). Internationalization as a general theory of foreign direct investment: a re appraisal of the literature. Review of World Economics, 116. doi:10.1007/BF02696864.

Schwab, K. (Ed.). (2018). The global competitiveness report 2018. Retrieved 01.12.2020 from http://www3.weforum.org.

Schwab, K. (Ed.). (2019) The global competitiveness report 2019. Retrieved 01.12.2020 from http://www3.weforum.org.

Streeck, W., & Thelen, K. (Eds.). (2005). Beyond continuity: exploration in the dynamics of advanced political economies. Oxford: Oxford University Press.

Tanaka, H., & Iwaisako, T. (2014). Intellectual property rights and foreign direct investment: a welfare analysis. European Economic Review, 67. doi:10.1016/j.euroecorev.2014.01.013.

Tesch, P. (1980). Die Bestimmungsgründe des Internationalen Handels und der Direktinvestitionen. Berlin: Dunker und Humblot.

UNCTADstat. (2020). Retrieved 28.12.2020 from https://unctadstat.unctad.org.

Wan, W.P. (2005). Country resource environments, firm capabilities, and corporate diversification strategies. Journal of Management Studies, 42(1). doi:10.1111/j.1467-6486.2005.00492.x.

Wilkin, J. (2016). Instytucjonalne i kulturowe podstawy gospodarowania. Warszawa: Scholar.

Williamson, O.E. (2000). The New Institutional Economics: Taking Stocks, Looking Ahead. Journal of Economics Literature, 38(3).

World Bank. (2020). Global Competitiveness Index. Retrieved 01.12.2020 from https://govdata360.worldbank.org.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Catallaxy

This work is licensed under a Creative Commons Attribution 4.0 International License.